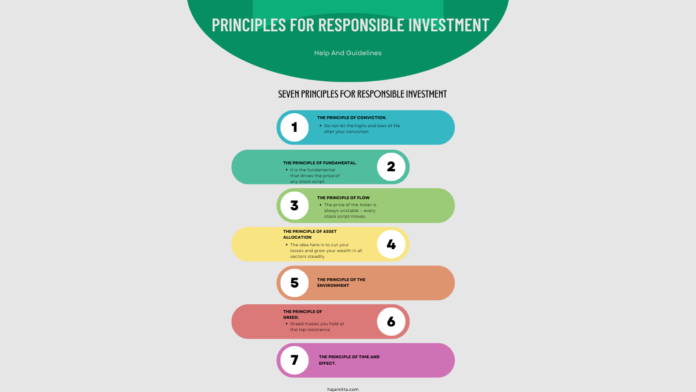

The principle of conviction

The stock you choose is your choice. If you panic when the price falls below your expectation, you don’t have a conviction in your will. It will help if you do not live in uncertainty and doubt. Always remember why you bought the stock at a specific price in the first place. The most significant losses happen after the first big profits.

Do not let the highs and lows of life alter your conviction. Your ego should not control your investment strategy. The fear, uncertainty, and doubt will make you lose a significant profit. You might sell at losses which is not why you invested, or you might take a minimal gain. Be firm about your decision and know to sell at the right price.

The principle of Fundamental

The hype of the particular stock is for the short term. You don’t want to invest in a place that gives you wealth for six months. Instead, focus on stocks that pay you for 60 years. Everything is fundamental.

It is the fundamental that drives the price of any stock script. If the company is not making any profit and thrives in massive debt, your portfolio will go red. The bullish movement of any stock is directly related to its fundamentals. The stores with good fundamentals have solid support in the bear market.

The principle of Flow

The price of the ticker is always unstable — every stock script moves. The market determines the flow. There is no universal constant price. A good investor should take their position and know if their chosen stock is overvalued or undervalued. A good trader rides the wave. The flow determines the support and resistance, which are ever-changing.

A little move or an unexpected move is the law of the market. The market psychology is unpredictable. One wrong trading concept can hinder your flow and move you negatively. Many traders and investors quit their position with small profit margins. The market doesn’t care about emotional values.

Control the flow of emotion.

It can be a problem when the investors change their strategy and switch their position to another stock; it can be a problem. There is no perfect investment options or perfect trading strategy. When the wrong action takes place, it can give an emotional hit. This moment is where the management of your pain level comes to arise. It’s better to manage the emotion before taking such actions.

Good investors and traders manage their emotional level before taking any action.

The principle of Asset Allocation

Your portfolio management is essential. Although concepts like “Put all your egg in one basket” are popular in Warren Buffet’s circle, it’s risky for others. There is great value if one can look into the market and know the right investment time. Better to diversify your portfolio than put all your money into a single stock.

The idea here is to cut your losses and grow your wealth in all sectors steadily. Also, your portfolio will become less volatile over time. The correct principle of asset allocation makes your portfolio grow. Even if the future potential looks strong, you should control your emotions and diversify your portfolio. Diversifying the portfolio is diversifying the risk.

The principle of the environment

If you spend your time with investors, you become the one. If you walk every day with the traders, you become the one. It is not the inside that shapes us most of the time—our surrounding matters. There are people in this world that has achieved more extraordinary human feats because of their friend circle. And if you are alone, what you read and where you put your mind on matters. Remember, everything starts from scratch, and it is up to you to mold yourself to fit in.

The principle of Greed

It is better to sell at the top than hold till the bear market. You will add years, not wealth. There has to be a balance between buying and selling. Do not choose one polarity. Greed makes you hold at the top resistance, and desire again makes you run the course of ‘fear of missing out.’

It isn’t easy to work to make money by trading. If the traders become greedy, their investments will get stuck when the price falls. Anyone who puts their money in the market should develop a portfolio that aligns with the current support and has extra cash to manage the risk.

The principle of Time and effect

The best time to buy the stock was 20 years ago; the second best time is now, whether it is the stock market or the crypto market. Whether gold or land, it is the early investors that make a large amount of profit. The key here is early. If you are late, remember that today is the best time to invest.

Tips:

More importantly, the prime goal for investing in the stock market is to make money. When the portfolio is green, people need to remember their strategy. We start to question only when there’s a wrong decision or when we hold a position during a market crash. Nevertheless, the ship has sailed. The principles are the tools by which we can minimize our risk.

Here are other investing principle guidelines and best investing tips for young adults.

– The number one thing is that investors must learn to take losses.

– Know yourself

– Learn to put your pride and guilt far from your market decision

– Make more analysis, and don’t just sit back and pray for the stocks to grow

– Don’t double your losses. Once the price is down, don’t choose another position in the same stock again.

– Trading is more complicated than you think.

– Always diversify and always feel comfortable with your strategy.

More on Hajarkitta.com: Stock Market General.