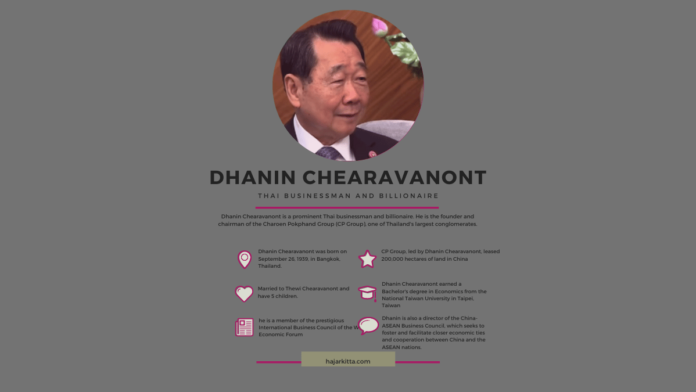

Dhanin Chearavanont is a prominent Thai businessman and billionaire. He is the founder and chairman of the Charoen Pokphand Group (CP Group), one of Thailand’s largest conglomerates.

Dhanin was born on 19 April 1939. He received higher education from the Education University of Hong Kong.

In 1961, Dhanin returned to Thailand and founded CP Group with his brother, Montri Jiaravanont. The company started as a small seed and animal feed business but has grown into a diversified conglomerate interested in telecommunications, agriculture, retail, real estate, and more.

Today, CP Group is one of the largest private companies in Asia, with operations in over 30 countries and more than 300,000 employees worldwide.

In addition to his prominent role as the founder and chairman of the Charoen Pokphand Group, Dhanin Chearavanont has also immersed himself in various other business ventures and organizations.

Notably, he is a member of the prestigious International Business Council of the World Economic Forum, a highly exclusive and elite organization comprising some of the most accomplished business leaders and entrepreneurs from across the globe.

Dhanin is also a director of the China-ASEAN Business Council, which seeks to foster and facilitate closer economic ties and cooperation between China and the ASEAN nations.

Furthermore, Dhanin’s considerable acumen and expertise have also led him to serve as the chairman of True Corporation, a well-established telecommunications firm in Thailand that has garnered significant market share and customer loyalty under his stewardship.

Evolution of Charoen Pokphand Group: From Feed Manufacturing to a Global Conglomerate

The Charoen Pokphand Group started by establishing the Chia Tai Chung seed shop in Bangkok’s Chinatown during the reign of King Rama VI. The shop was founded by two Chinese brothers, Chia Ek Chor and Chia Jin Hyang, who immigrated from Shantou, China.

The brothers began their business by purchasing seeds and vegetables from China and exporting pigs and eggs to other countries like Hong Kong, Taipei, Kuala Lumpur, and Singapore. This indicates that they were involved in international trade, despite having limited financial resources.

Moreover, the brothers conducted market research in the early years of their firm to define their market niche. This shows that they were strategic and forward-thinking in their approach to business, which may have contributed to the success of their shop.

Their business ventures started from the entrepreneurial spirit and determination of the Chia brothers, as well as their willingness to take risks and venture into new markets.

The Competitive Challenges Faced by Charoen Pokphand Group in the 1950s-1970s.

During the 1950s, the seed store shifted its focus to exporting animal feed, specifically for chickens. However, the business faced challenges until the 1970s, when the Bangkok Bank requested that it take over a failing chicken farm.

From there, the store concentrated on purchasing mature chickens for distribution to restaurants and grocers, using a vertically integrated approach that included feed-milling operations and chicken breeding.

By 1969, the company had an annual revenue of US$1-2 million. In the 1970s, as the Thai economy underwent liberalization, the CP Group engaged in business negotiations with major Thai banks, the Thai government, and foreign companies. Under the CP Group’s contract farming model, they supplied chicks and feed to Thai farmers and provided them with guidance on how to raise chickens.

In turn, the farmers sold the mature chickens back to the CP Group, which processed them and sold them to high-volume retailers, restaurants, and fast-food franchises throughout Thailand.

As Thailand transitioned to a capitalist economy in the 1980s, the CP Group ventured into the aquaculture industry, applying its formula to the raising and marketing of shrimp.

Global Expansion and New Markets: Charoen Pokphand Group’s International Endeavors in the 1980s

Initially known as “Rua Bin” (meaning “Aeroplane”), the firm began by selling vegetable seeds. However, under the direction of Ek Chor’s two oldest sons, Jaran Chiaravanont and Montri Jiaravanont, it gradually evolved into animal feed production and, eventually, livestock farming, marketing, and distribution.

By the 1970s, the corporation, led by Dhanin Chearavanont, had gained a near-monopoly on the supply of chickens and eggs in Thailand.

It became well-known for its vertical integration, expanding into various business areas such as breeding farms, slaughterhouses, processed food production, and even its restaurant chain.

To expand internationally, the business established feed mill operations in Indonesia in 1972, shipped chickens to Japan in 1973 and relocated to Singapore in 1976.

CP Group emerged as the ideal partner for worldwide companies such as Walmart, Honda, and Tesco when China opened up to foreign direct investment in the 1980s. Because of its familial ties in mainland China, the firm was the first foreign corporation to establish itself in the newly founded Shenzhen Special Economic Zone, where it established its subsidiary Chia Tai Co.

In 1987, CP acquired the ownership of both the 7-Eleven convenience store enterprise and the KFC fast food restaurant franchise. Furthermore, the firm expanded its activities to Shanghai, where it built bikes under a Honda license and brewed beer under a Heineken license.

In 1989, the business joined the petrochemical industry by forming Vinythai Co. with Solvay of Belgium to make polyvinyl chloride.

For around $3 billion, CP Group bought a stake in TelecomAsia, a joint venture with the US-based telecoms company NYNEX to develop and run two million telephone lines in Bangkok.

The corporation also invests in satellite launches, cable television, and mobile phone services.

How did Dhanin Chearavanont get so rich?

Dhanin Chearavanont’s immense fortune is mainly derived from his position as the founder and chairman of the Charoen Pokphand Group (CP Group), which is one of the most prominent and influential conglomerates in Thailand. The CP Group has a substantial international presence and operates across various industries, such as agriculture, food, retail, telecommunications, and real estate.

Apart from CP Group, Dhanin has also invested in various other businesses and organizations, including True Corporation and the China-ASEAN Business Council, contributing to his wealth.

Dhanin Chearavanont Family

The family’s financial success has led to their recognition as one of the wealthiest ethnic Chinese families in the world.

The fact that the family was ranked as Asia’s fourth-wealthiest family by Forbes Asia in 2017, with a net worth of US$36.6 billion, provides concrete evidence of their financial achievements.

The family’s business roots can be traced back to Dhanin’s father, Ekchor Saechia, and uncle, Seowhui Saechia, who immigrated to Bangkok from China in the 1920s and started selling seeds and agricultural chemicals.

Dhanin Chearavanont has three siblings – Jaran, Montri, and Sumet – and several cousins. Dhanin is also the father of two daughters, Varnnee Chearavanont Ross and Tipaporn Chearavanont.